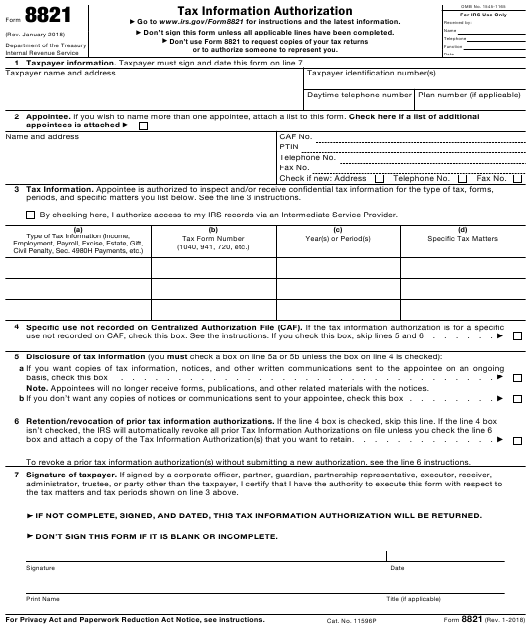

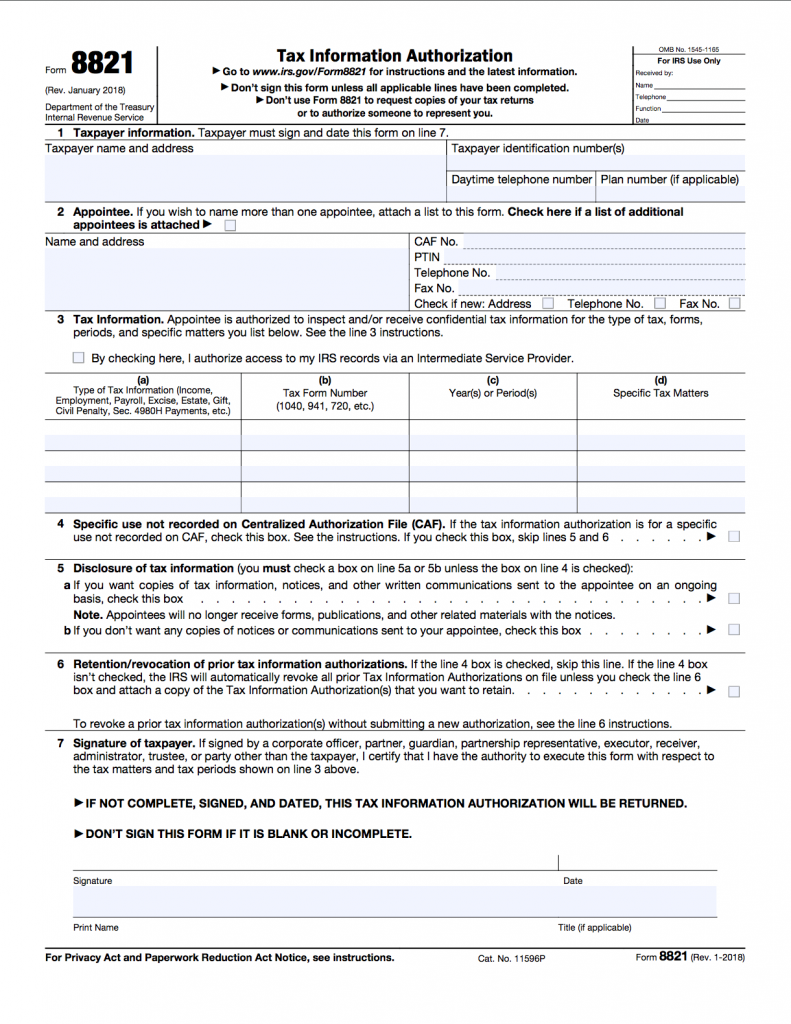

Irs Tax Authorization Form 8821 – An authorization form is legal and binding document that gives permission to perform a particular procedure, like accessing medical information, personal information or financial transactions. Create a concise and easy authorization form that ensures everyone affected knows their rights and obligations.

The Importance of Authorization Forms

Authorization forms play a vital function in protecting rights and privacy of individuals. They are utilized to obtain the approval of the person who is authorizing and also to establish an understanding between all parties. When you create a well-crafted authorization form, it is possible to avoid legal disputes.

Data Protection

When drafting the authorization form you must be sure to comply with all relevant legal requirements, including data protection laws. Legal requirements could differ from one jurisdiction to another, which is why it is recommended to consult an attorney to make sure that your form is compliant with all legal requirements. A data protection plan will ensure the privacy of all parties involved.

Best Practices for creating Forms for Authorization Form

- Utilize a simple and direct language.

- Define a reason Don’t use too broad words and clearly state the reason for your use.

- Limiting the scope: Clarify the extent and limitations of the authorization.

- Add the option of revocation The grantor is able to revoke his authorization at any moment.

- Sign the form: Make sure there is space on the form that is for the name of the grantor to signify consent.

Step by step instructions for designing a Authorization Form

- Begin with an HTML Template

Utilizing a template, you will save time while ensuring that your form contains all the necessary components. Find reliable sources for authorization form samples, such online legal resources as well as document templates on websites. Choose a template that is specifically designed for the type of authorization you require and customize it as needed to suit your specific needs.

- Add a company or an organization

The top of your form should contain the name of your business, its address, and any contact information. This allows the form to be considered an official document, and also helps to identify all those that are responsible for the submission.

- Give an explicit and specific justification for authorizing the use

It is important to clearly state the intent of the authorization, and also identify the specific actions or responsibilities involved. If you’re filling out a form for an authorization to treat a medical condition, then specify what treatment, procedure or medication is being approved.

- Establish a timeframe to allow

Set a date for the start and an end date or an event that triggers the expiration. A defined timeframe will protect the rights of the grantor, and prevent the authorization from being open-ended.

- Define the scope and limitations of the authorization

Define the scope of authorization, which includes limitations or limitations. If it is a form for financial transactions such as a financial transaction form, then provide the maximum amount which can be transferred, or the types transactions allowed.

- Include a revocation clause

The grantor should be given instructions to revoke the authorization at any point. This is done by sending a request in writing or by filling out a separate form.

- Gathering information regarding the grantor

The full name, address and contact information of the person who is granting the authority are required. This will confirm the identity of grantors and also provides contact details to address any concerns or questions.

- Give a space where the grantee is able to sign their name and add the date

Include a designated area for the grantor to fill in and date the form, confirming their consent to the authorization. Be sure to clearly label the area for signature and include a declaration that confirms grantor’s understanding of the content of the form as well as their consent.

- Incorporate any necessary witnesses or notary sections

If your state requires a notary or witness public to validate the form, make sure you include the appropriate sections to verify their signatures and information. Talk to a lawyer to determine whether this step is required for the type of authorization you’re using.

Conclusion

To ensure the rights of both parties as well as their privacy, it is essential to make an authorization form that’s well-organized in English and is compliant to all laws applicable. By following the guidelines and best practices outlined in this document, you can design a strong authorization form. It will accomplish its purpose and stand up legal scrutiny. Consult with your legal advisor so that you can ensure your form is in compliance with legal requirements.